These Are The 5 Best Stocks To Buy And Watch Now By Investors Business Daily

Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a watchlist? Intuitive Surgical (ISRG), S&P Global (SPGI), NetEase (NTES), West Pharmaceutical Services (WST) and Zoetis (ZTS) are making moves as the stock market rally continues to bounce back from the coronavirus crash.

Since the coronavirus bear market, stocks have rebounded powerfully. Strong recent action reflects a rising confidence that the economy will eventually recover from the Covid-19-caused shutdown. The stock market finished the week with solid gains Friday, with the S&P 500 and the Nasdaq setting record closing highs.

The stock market rally remains in a confirmed uptrend, with growth names generally outperforming. There also has been encouraging action from stocks in the bottom half of IBD’s rankings of six-month performance.

So why are these five names above the rest to buy or watch? Before turning to that question, it is important to consider how one goes about choosing a stock in the first place. Superior fundamentals and technical action, and buying at the right time, are all part of a shrewd investing formula.

Several of the stocks named are featured on IBD’s prestigious Leaderboard list of top stocks.

Best Stocks To Buy: The Crucial Ingredients

Remember, there are thousands of stocks trading on the NYSE and Nasdaq. But you want to find the very best stocks right now to generate massive gains.

The CAN SLIM system offers clear guidelines on what you should be looking for. Invest in stocks with recent quarterly and annual earnings growth of at least 25%. Look for companies that have new, game-changing products and services. Also consider not-yet-profitable companies, often recent IPOs, that are generating tremendous revenue growth.

IBD’s CAN SLIM Investing System has a proven track record of significantly outperforming the S&P 500. Outdoing this industry benchmark is key to generating exceptional returns over the long term.

In addition, keep an eye on supply and demand for the stock itself, focus on leading stocks in top industry groups, and aim for stocks with strong institutional support.

Once you have found a stock that fits the criteria, it is then time to turn to stock charts to plot a good entry point. You should wait for a stock to form a base, and then buy once it reaches a buy point, ideally in heavy volume. In many cases, a stock reaches a proper buy point when it breaks above the original high on the left side of the base.

Don’t Forget The M When Buying Stocks

Never forget that the M in CAN SLIM stands for market. Most stocks, even the very best, will tend to follow the market direction. Invest when the stock market is in a confirmed uptrend and move to cash when the stock market goes into a correction.

The current stock market rally became a confirmed uptrend after the S&P 500 staged a somewhat lackluster follow-through day on April 2. It has managed to overcome several sharp sell-offs, with even a spike in Covid-19 cases failing to quell optimism.

One factor weighing on the stock market was a stalemate in Congress on a new coronavirus aid bill. However, President Donald Trump carried out executive orders to partially extend unemployment benefits and give student loan relief.

The best market gains often come in the first several weeks after a correction or bear market ends, so investors should be looking for stocks with good fundamental and technical performance, ones capable of staging successful breakouts. More quality stocks are also breaking out now. On a technical basis, look for stocks with rising relative strength lines.

Nevertheless, things can quickly change, so investors should keep a close eye on the market trend page here.

Best Stocks To Buy Or Watch

Now let’s look at Intuitive Surgical, S&P Global, NetEase, West Pharmaceutical Services and Zoetis in more detail. An important consideration is that these stocks all boast impressive relative strength. Several of these stocks are on the watchlist to possibly joing IBD Long-Term Leaders.

Another important aspect is that these stocks could help diversify a portfolio of chip, software and U.S. internet holdings. Three of these stocks are medicals, each in their own fields. One is a financial markets data operator and the fifth, though a tech stock, is based in China.

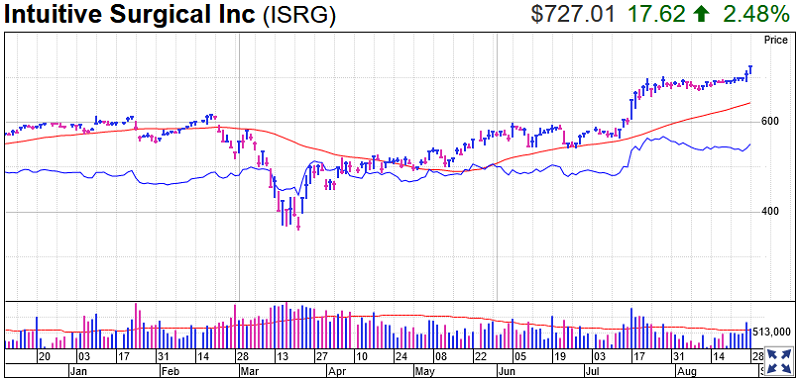

Intuitive Surgical Stock

The Aug. 14 IBD Stock Of The Day is in a buy zone after trading tightly for four weeks. The ideal buy point is 704.10.

Intuitive Surgical stock has been consolidating after it extended a breakout from a cup-with-handle base following its second-quarter earnings report last month.

The relative strength line of Intuitive Surgical stock has fallen from highs reached late last month. This gauges a stocks performance vs. the broader S&P 500 index. But the RS line gapped higher on the mid-July ISRG breakout. Previously, the RS line had moved sideways for about 18 months, but that followed a multiyear advance.

ISRG stock has a strong Composite Rating of 91. IBD Stock Checkup shows Intuitive’s earnings are not as strong as its stock market performance. Nevertheless, the impact of Covid-19 has seen the stock post an average EPS decline of 11% over the past three quarters. But earnings have grown by an average of 15% over the past three years.

The company’s second-quarter results came in far above analysts’ expectations. However, profit and sales fell, as the coronavirus pandemic kept people away from elective procedures.

The robotic-assisted surgery provider is best known for its robotic da Vinci Surgical System. That system — a set of enhanced surgical instruments that a surgeon operates via a console — is used for procedures in urology, gynecology and elsewhere. Procedures using that system fell 19% during that quarter, as patients put off operations. Shipments of the system fell 35%.

In the U.S., the company will be navigating a patchwork of states with different levels of coronavirus cases and restrictions.

“The impact and timing of the Covid-19 pandemic on the company’s business differs by geography,” Intuitive said in its second-quarter earnings release. “In the U.S., for example, while da Vinci procedures recovered a significant portion of the pre-Covid-19 levels, the resurgence of Covid-19 in some states has, and will likely continue to, adversely impact the company’s procedure volumes.”

But with Covid-19 cases well off their July peaks, many patients are starting to resume doctor visits and elective procedures, good news for Intuitive Surgical and several other medical stocks.

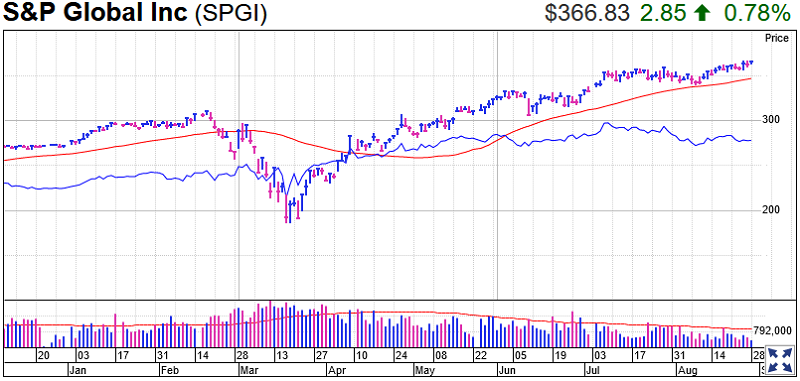

S&P Global Stock

S&P Global stock is still buyable after staging a rebound off its 10-week line and then clearing a four-weeks-tight pattern with a 360.10 entry. SPGI is 5.1% above its 10-week line.

The relative strength line for SPGI stock looks to be turning positive again after a recent decline. It has taken a breather after making steady progress throughout the year up until mid July.

S&P Global stock has an IBD Composite Rating of 96 out of 99. IBD Stock Checkup shows S&P Global has an EPS Rating of 98, with average earnings growth of 27% over the past three quarters just above CAN SLIM requirements for 25% growth.

The financial information and analytics firm boasts strong and consistent growth. It is this excellent performance that has put the stock on the Long-Term Leaders waitlist for possible inclusion in the group of 20 all-stars.

In a nutshell, an IBD Long-Term Leader is a stock with stable earnings, stable price performance, and high-quality institutional sponsorship that will outperform the market. These are stocks that you buy and, within reason, hold.

S&P Global’s strong track record is continuing amid the coronavirus. Earnings rose by 14% in the fourth quarter, followed by a 29% gain in Q1 and a 40% gain in Q2. The company has notched earnings gains since 2013, and is expected to put up a 15% gain this year, even as the coronavirus pandemic guts the bottom line for many companies.

However, S&P Global late last month said the pandemic led to a “surge” of corporate bond issuance during the second quarter, as businesses raised debt to pad themselves financially. The flood of issuances means more debt for S&P Global to evaluate. The company makes money off those ratings, which investors use to determine how risky that debt is.

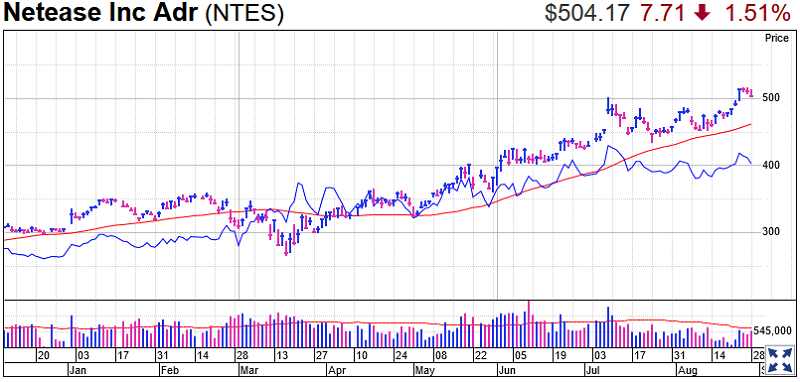

NetEase Stock

The China stock is in buy zone after breaking out of a flat base to a new high. The official buy point is 503.37, following an early entry at 487.21. The stock has been on the charge since late March.

The relative strength line is not far from highs after edging lower during NetEase’s brief consolidation. Before that, the RS line rallied strongly for a full 12 months..

NetEase stock has a Composite Rating of 99. In addition, the Stock Checkup Tool shows it boasts a good mix of earnings and stock market performance.

The Chinese video game publisher has been advancing since easily beating Wall Street’s targets for the second quarter on Aug. 13.

The Hangzhou, China-based company earned an adjusted $5.64 per American depositary share on sales of $2.57 billion in the June quarter. Analysts expected NetEase earnings of $4.58 per U.S. share on sales of $2.45 billion. In the year-earlier period, NetEase earnings were $4.27 per U.S. share on sales of $2.68 billion.

“We saw healthy gains across our business in the second quarter,” CEO William Ding said in a news release. “Strong performances from our online game services and NetEase Cloud Music” drove the growth, he said.

He also said that “continuous expansion” of the firm’s “abundant games pipeline” has made him confident the firm will expand its reach to a broader market.

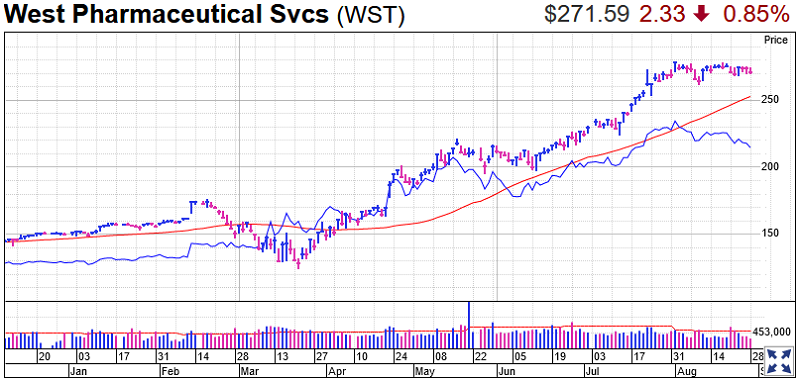

West Pharmaceutical Stock

West Pharmaceutical stock has been trading tightly of late, setting up a potential buy point of 279.64. It is well clear of its 50-day line.

The RS line has dipped during WST’s consolidation, but that followed strong outperformance in 2020. The RS line has generally been trending higher since 2000. No surprise that WST stock is on the Long-Term Leader waitlist.

West Pharmaceutical stock has a near-perfect Composite Rating of 98. The Stock Checkup Tool shows earnings are very strong, while stock market performance is also excellent. This is reflected in its RS Rating of 94. The stock is up around 80% so far this year.

On July 23, it delivered Q2 results that beat views. Earnings rose 40% to $1.25 a share, while sales increased 12% to $527.2 million. That marked a third straight quarter of double-digit growth for both the top and bottom lines.

The recent IBD 50 Stock To Watch also boosted its diluted full-year EPS forecast to $4.15-$4.25 from its prior guidance for $3.52-$3.62.

West Pharmaceutical is benefiting somewhat from coronavirus demands.

While the Exton, Pa.-based company isn’t itself a drugmaker, it makes syringes and vial components needed to inject medicines. So its products can help deliver Covid-19 vaccines. Its gear is also used in medical devices and diagnostic tools.

The firm’s CEO Eric Green boasted the firm is focusing on helping the Covid-19 fight during the firm’s most recent earnings call.

“The pandemic remains our priority. Given the ever-changing situation, there’s a huge sense of urgency in vaccine development,” he said. “We’re helping our customers in the selection, testing and verification of components. We’re doing this in a way that prepares our customers for the future commercial scale up and launch of any successful vaccine candidates.”

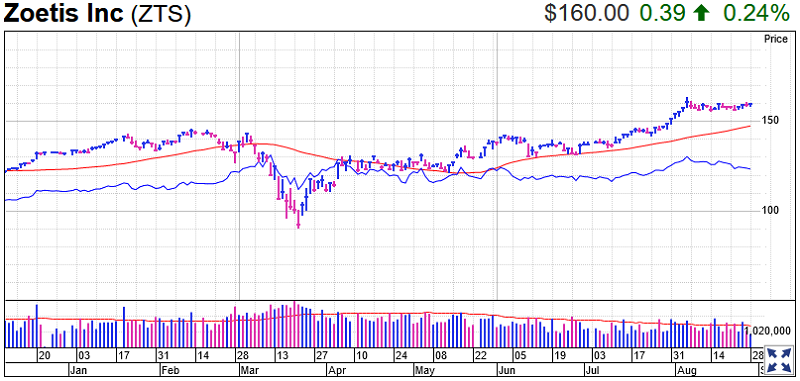

Zoetis Stock

The animal medicine producer has been trading tightly. Zoetis stock has a four-weeks-tight pattern that could turn into a flat base. The buy point is 164.08.

The current consolidation is forming above a flat base, which was next to a cup-with-handle pattern.

The RS line hit a record high in early August and has edged lower during the current ZTS stock consolidation. The RS line has only inched higher in 2020, but that follows a stretch of outperfromance going back to early 2014, not that long after Zoetis was spun off from Pfizer (PFE). Zoetis also is on the Long-Term Leaders wait list.

The stock’s Composite Rating of 89 is good, but not ideal. The Stock Checkup Tool shows earnings are superior to stock market performance. This is reflected in the RS Rating of 80. Over the last three quarters EPS has grown by an average of 7%, which is below CAN SLIM requirements. Longer-term growth is better, with average earnings growth coming in at 22% over the past three years.

At the start of August, Zoetis reported second-quarter earnings and sales that handily beat Wall Street expectations. It also raised guidance.

For the year, Zoetis forecasts earnings of $3.52 to $3.68 a share, on sales of $6.3 billion to $6.475 billion. Analysts project earnings of $3.36 per share on $6.17 billion in sales. At the midpoint of Zoetis’ forecasts, earnings would fall 8% while sales slip 1%.

Veterinary offices have remained open during the Covid-19 pandemic. They’ve been deemed “essential” by most, if not all, states. Veterinary offices have often employed curbside drop-off and pickup services, for pets and medicines.

“This was a strong quarter for Zoetis, despite challenges related to Covid-19,” Edward Jones analyst Ashtyn Evans said in a note to clients. “Overall vet visits declined in the quarter, but the company still experienced growth of 11% in companion animal, driven by new products in dermatology and parasite management.”

CFRA Research analyst Sel Hardy was also impressed. She raised her 12-month price target on ZTS stock to 172 from 153 and maintained a strong buy rating.

September 11 Peak Performance 101 Streaming Workshop

Trading Education Online Courses