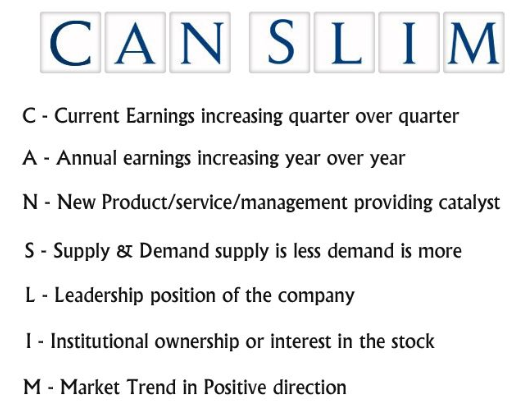

Can The CAN SLIM Investing Method Succeed In Algorithmic Trading? By Investors Business Daily

Can the CAN SLIM Method of picking great stocks succeed in algorithmic trading? Executives at O’Neil Global Advisors (OGA) think so.

They express confidence in long-term demand for a computerized system of investing and trading. Plus, OGA officials expect strong interest among institutional investors and high-net-worth individuals in two major economies of the world: China and India.

On May 18, OGA said it launched a set of investment strategies that use algorithmic programs. These strategies capitalize on decades of research on the key factors behind winning and losing stocks. The strategies even sport unique names: Chameleon, Raven and Timberwolf.

The goal? To “continue William J. O’Neil’s legacy with consistent innovation, supported by cutting-edge quantitative research, and applying those findings to create strategies that outperform the market,” O’Neil Global Advisors CEO Steve Birch said in a news release.

Is This William O’Neil 3.0?

William O’Neil founded an institutional equity research firm that bears his name more than 50 years ago. The former U.S. Air Force member and Hayden Stone stock broker also bought a seat on the NYSE at age 29.

In 1984, O’Neil then created Investor’s Business Daily. The former daily newspaper, now known as IBD Weekly, etched history as the first in the U.S. to help traders adopt a soup-to-nuts strategy for timing the market correctly. The methodology covers selecting, buying and selling big stock market winners according to a well-defined set of rules.

Today, millions of articles, charts and screens get viewed each month at Investors.com. In recent years, IBD powered new successful online products Leaderboard and SwingTrader.

Randy Watts, OGA’s chief investment officer, notes equity investing can be difficult for most individuals and even fund managers. Why? They succumb to emotions.

“Buy low, sell high” is a misnomer. No doubt, research has shown a majority of professional investors fail to beat the S&P 500 over time. Unfortunately, many amateurs and pros often commit the mistake of buying near market highs and throwing in the towel at major lows.

“We felt we could take the elements of Bill O’Neil’s methodology developed over decades, put them into quantitative algorithms, eliminate problems with human emotions, and create what we think are positive strategies,” Watts told IBD.

A Tech Advantage In CAN SLIM Investing

Indeed, technology and the markets keep evolving. Thus, OGA has striven to stay on the bleeding edge.

Its team boasts 55 technology associates. Among them, 29 specialize in quantitative engineering, technical architecture and data science.

Also, OGA employs a database that has a mother lode of fundamental, technical and institutional share ownership data in thousands of stocks. O’Neil built it with the help of an IBM mainframe computer in the 1960s. Plus, the database itself goes as far back as the huge railroad stocks of the late 19th century. This data may give OGA’s quantitative strategies an edge.

Watts argues the CAN SLIM method of selecting the strongest growth stocks can thrive across a variety of time horizons. Decades of expertise in analyzing the most successful chart patterns also make these new strategies unique.

Algorithmic Trading And CAN SLIM Investing; 3 New Quantitative Strategies

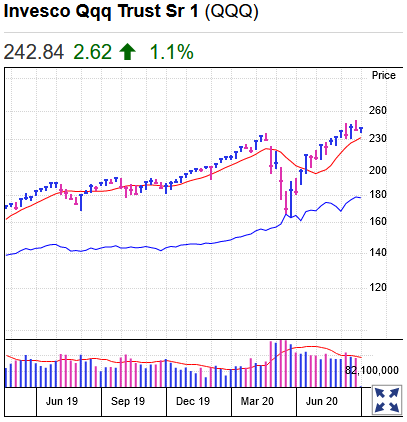

The Chameleon quant strategy invests only in Invesco QQQ Trust (QQQ), which tracks the Nasdaq 100. Watts says Chameleon gets its name for an “ability to shift from long to short to cash.” It will employ classic O’Neil-style chart patterns such as the cup with handle.

Chameleon will adjust exposure based on key market turns. Here, distribution day analysis helps investors to determine the right time to cut exposure. Second, the follow-through day concept serves an important timing signal for entering back into stocks.

The Raven algorithmic trading strategy offers these features. First, it targets companies that meet CAN SLIM principles. Second, it goes long in stocks that show positive momentum in fundamentals, breakouts and positive chart action. And three, Raven sells short names with a weakening earnings and technical picture

Finally, Timberwolf aims to find the “lone wolves” of the market. How so? This algorithmic trading strategy goes long in stocks with excellent earnings stability. Timberwolf will employ a proprietary factor rating developed by William O’Neil + Co. In addition, it will go short in companies with high earnings variability.

“We feel that over time, companies with a high earnings stability outperform those with high earnings variability,” Watts said.

China And India Market Potential In Algorithmic Trading

OGA’s William O’Neil Investment Management Co. manages seven quantitative strategies for domestic clients in China. In late April, the Shanghai-based firm received the country’s 26th license as a foreign-funded private manager to operate there.

“We think the China stock market is a great opportunity as the Chinese population learns about investing, per capita income grows, and as it becomes more comfortable with equity investing,” Watts said. “O’Neil’s book, ‘How to Make Money in Stocks,’ has been available in China for many years.”

Meanwhile, five quantitative strategies got approval from India’s regulators in April. They target high net worth and institutional investors.

“We think India will be one of the largest secular growth stories for several decades,” Watts noted.

Trading Education Online Courses

TracknTrade Trading Software Free Trial