More Airlines Plan Big Layoffs Despite Taking Billions In Bailout Money By Investors Business Daily

American Airlines stock fell Thursday after a letter to employees outlining planned job cuts due to the coronavirus surfaced late Wednesday. Delta Air Lines (DAL) also began offering early retirements and voluntary buyouts.

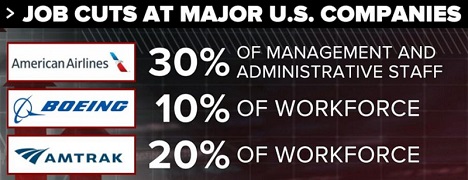

In the staff letter, American Airlines (AAL) said it would cut its management and support staff by 30% and could cut frontline employees like flight attendants following the severe drop in travel amid the coronavirus crisis.

American is first going to accept volunteers for buyouts through June 10, then announce them in July. But the employees will remain on the payroll through Sept. 30 as mandated by the bailout terms from the federal government.

American has received $5.8 billion in bailout money so far and has applied for another $4.75 billion.

“We must plan for operating a smaller airline for the foreseeable future,” Elise Eberwein, American’s executive VP of people and global engagement, wrote to staff Wednesday.

Delta Air Lines detailed voluntary job cuts Thursday, with additional plans to offer early retirement to its unionized pilots expected to come out next week, according to a memo seen by CNBC.

The job losses add to the mounting toll in the aviation sector. On Wednesday, Boeing (BA) said it was cutting 12,000 jobs, including nearly 7,000 involuntary layoffs as demand for aircraft falls amid Covid-19. United Airlines (UAL) has also warned of a 30% cut in administrative staff, or at least 3,450 people.

United has received about $5 billion in bailout money and Delta about $5.4 billion as part of an overall $25 billion federal rescue for the industry.

American Airlines Stock

Shares fell 8.35% to 10.98 on the stock market today. American Airlines stock is now testing its 50-day line and still well under its 200-day line, according to MarketSmith chart analysis. United shares were down 5.9%, Delta lost 2.5%, Southwest Airlines (LUV) fell 3.3%. Boeing climbed 0.2% after restarting 737 Max production, but closed well off session highs.

While travel demand has seen a slight monthly uptick, lifting American Airlines stock and its peers, a full recovery is years away.

Air travel fell 96% in April and the International Air Transport Association estimates that passenger traffic won’t return to prepandemic levels until 2023.

Also Wednesday, American Airlines CEO Doug Parker said he expects the U.S. industry will be 20%-25% smaller next summer vs. 2019 but dismissed speculation that a major U.S. carrier will go out of business.

Trading Education Online Courses

TracknTrade Trading Software Free Trial