A Surprisingly Effective Sentiment Indicator By Van Tharp Trading Institute

“The herd instinct among forecasters makes sheep look like independent thinkers.”

—Edgar R. Fiedler

I bet you had a friend or two in high school and/or college that helped you think outside the box. These are the kind of folks who challenged you, either directly or indirectly, to look at things in a different way. They are few and far between.

My friend Donna was just like that. She dated one of my best friends through most of high school, so we saw each other often but weren’t romantically involved (though we did flirt a lot, just to mess with my friend).

Donna had a great sense of humor and was so very sharp. And, she has always had a different way of looking at the world. That gift of seeing things differently was so important to me. I was a particularly naïve and forgiving guy in high school. Donna was the one who would always point out when I was giving someone the benefit of the doubt when they didn’t deserve it. She brought a healthy dose of realism to my optimistic worldview, especially as it related to how people treat each other.

Donna became an industrial psychologist and her enthusiasm for working with people showed up in both high school and college where she was involved in peer counseling. After consoling countless young women who had been treated poorly by the males in their lives, Donna proclaimed to me that all men fit into one of two categories: big jerks or little jerks. (She, however, used a word that was less polite than “jerk.”) She was also quick to point out that I was merely a “little jerk”, which made me feel somewhat better… But no matter what, I could always count on Donna to give me a unique view of the world around us.

In a similar way, I enjoy tools that give me a different take on the market. Sentiment indicators can be very useful at market inflection points. I’ve been looking at one that is new to me and it seems to provide some useful and thought-provoking data.

A Lesser-Known Sentiment Indicator

Years ago, a top trader that I know pointed out an indicator that he’d been watching – the Citigroup U.S. Economic Surprise Index. Stay with me here, this is a real indicator! Later in the article, I’ll show you how you can find it regularly updated with some useful relationships thrown in.

In short, the Citigroup U.S. Economic Surprise Index quantitatively shows how actual economic data have trended versus consensus economist expectations. The index measures the magnitude of difference between published expectation and announced data, weighing both more recent announcements and market-moving announcements more heavily.

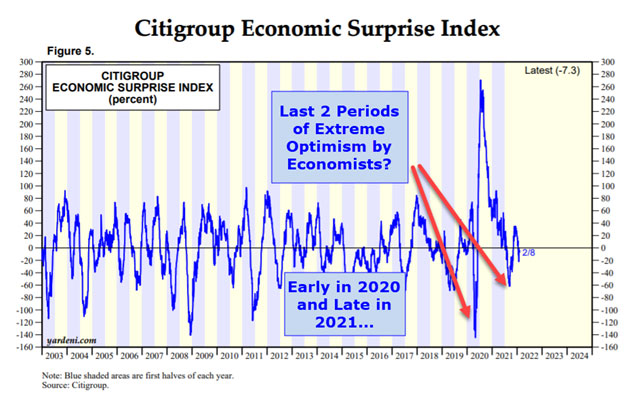

If the data are better than consensus expectations, a positive value is registered; if the numbers are worse, then the index goes negative. The chart below shows data from Citigroup dating back to 2003 as reported by Ed Yardeni:

In this chart, you can see that when economists get too optimistic (we’ll see how that works below), it can lead to a short-term market pullback like we saw after the optimistic periods of early 2020 and late 2021. The move up in the indicator this week (2/8/22 on the chart, though it’s hard to see) shows that after the ultra-fast market correction in January, economists are starting to lose their extreme optimism. This is modestly bullish, from a sentiment perspective.

But as you can see, this is not the “normal” sentiment indicator. Most sentiment indicators like the survey of the American Association of Individual Investors (AAII) are contrarian – when too many people are bullish, the market is due for a pullback.

The Economic Surprise Index does describe contrarian behavior, but a high reading on the chart does not mean the market is heading down. More on the logic follows.

Let’s take a quick look at the logic for this index:

- High readings occur when: The actual economic data are consistently exceeding expectations. This happens when the economists are pessimistic and keep projecting numbers that are too low. At these times, markets tend to head higher in the next 2 – 8 weeks.

- Low readings occur when: The economists are too optimistic. At times when economists consistently project numbers that are too high, the economic data disappoints, giving low readings on the Surprise Index. At these stretch points, the markets are due for a correction.

- Middle of the road readings: Like most sentiment indicators, neutral readings provide us with little directional indication. However, for this particular index, the trend is usually important. When the Economic Surprise Index is trending up, it is showing increasing pessimism. When it trends down, it is showing increasing optimism. This knowledge can at least give us some flavor for what is happening in the macroeconomic world.

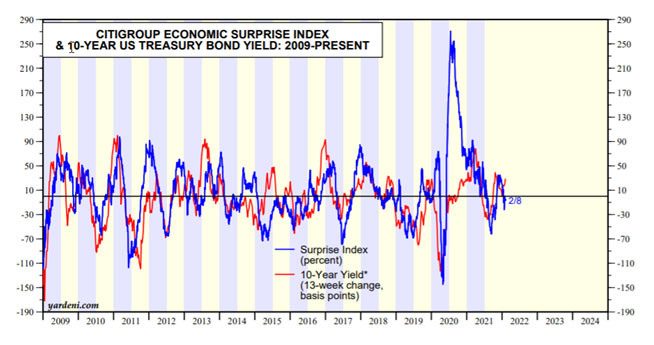

Bloomberg.com used to be my go-to for this indicator, but they don’t carry it anymore. A link where you can find it now is at the end of this article. Ed Yardeni, who publishes those charts, shows an intermediate-term relationship between U.S. 10-year Note yields and the Surprise Index. You can see for yourself in the chart below and if enough readers are interested, I’ll dig deeper into this relationship in a future article.

Van Tharp Trading Institute Home Study Products