These Are The 5 Best Stocks To Buy And Watch Now By Investors Business Daily

Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a watchlist? Microsoft (MSFT), Axon Enterprise (AAXN), Chipotle Mexican Grill (CMG), Insulet (PODD) and Pool (POOL), are looking stronger as the stock market continues to bounce back from the severe coronavirus correction.

While the long bull market was finally vanquished by the coronavirus crisis, things are again looking up. The stock market is once again in a confirmed uptrend. The rally has been strengthening, with the tech-heavy Nasdaq clearing key resistance levels and more top stocks breaking out.

A key to this is the improving news on Covid-19, both in the U.S. and around the world. Many states are now looking at how they are going to come out of lockdown and get their economies firing again. However, stress in the oil markets has added to uncertainty.

So why are these five names above the rest to buy or watch? Before turning to that question it is important to consider how one goes about choosing a stock in the first place. Superior fundamentals and technical action, and buying at the right time, are all part of a shrewd investing formula.

Several of the stocks named are featured on IBD’s prestigious Leaderboard list of top stocks.

Best Stocks To Buy: The Crucial Ingredients

Remember, there are thousands of stocks trading on the NYSE and Nasdaq. But you want to find the very best stocks right now to generate massive gains.

The CAN SLIM system offers clear guidelines on what you should be looking for. Invest in stocks with current quarterly and annual earnings growth of at least 25%. Look for companies that have new, game-changing products and services. Also consider not-yet-profitable companies, often recent IPOs, that are generating tremendous revenue growth.

IBD’s CAN SLIM Investing System has a proven track record of significantly outperforming the S&P 500. Outdoing this industry benchmark is key to generating exceptional returns over the long term.

In addition, keep an eye on supply and demand for the stock itself, focus on leading stocks in top industry groups and aim for stocks with strong institutional support.

Once you have found a stock that fits the criteria, it is then time to turn to stock charts to plot a good entry point. You should wait for a stock to form a base, and then buy once it reaches a buy point, ideally in heavy volume. In many cases, a stock reaches a proper buy point when it breaks above the original high on the left side of the base. More information on what a base is, and how charts can be used to win big on the stock market, can be found here.

Don’t Forget The ‘M’ When Buying Stocks

Never forget that the “M” in CAN SLIM stands for market. Most stocks, even the very best, will tend to follow the market direction. Invest when the stock market is in a confirmed uptrend and move to cash when the stock market goes into a correction.

The current stock market rally became a confirmed uptrend after the S&P 500 staged a somewhat lackluster follow-through day on April 2. The Nasdaq’s April 6 follow-through day was more convincing, while breakouts have been flourishing.

The best market gains often come in the first several weeks after a correction or bear market ends, so investors should be looking for stocks with good fundamental and technical performance, ones capable of staging successful breakouts. More quality stocks are also breaking out now. On a technical basis, look for stocks with rising relative strength lines.

Nevertheless, things can quickly change, so investors should keep a close eye on the market trend page here.

Best Stocks To Buy Or Watch

Now let’s look at Microsoft stock, Axon Enterprise stock, Chipotle Mexican Grill stock, Insulet stock and Pool stock in more detail. An important consideration is that these stocks all boast impressive relative strength.

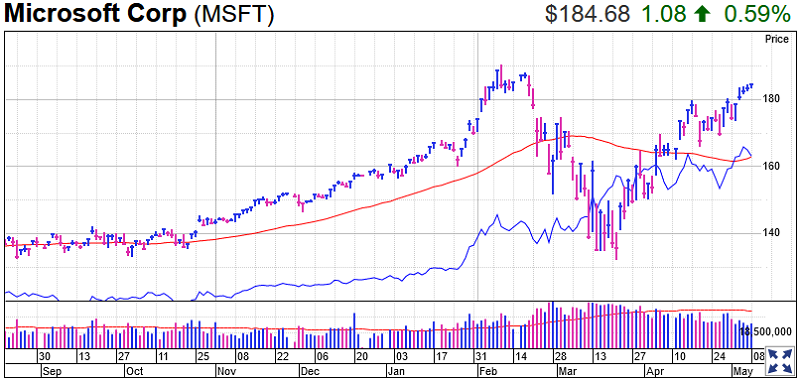

Microsoft Stock

Microsoft stock rose 5.8% in the week ended May 9 to 184.68. MSFT stock is now extended from an original 175.10 buy point on a double-bottom base. But it’s still in buy range from a 180.10 handle.

In the latter half of April, Microsoft stock rose in a rolling, uneven fashion, echoing the action of the stock market rally. Even leading stocks will tend to follow the market. And Microsoft is a leader. The relative strength line for Microsoft stock is just off highs, and climbed solidly through the market crash and in the current stock market rally.

The RS line, the blue line in the charts below, tracks a stock’s performance vs. the S&P 500.

Microsoft stock has been outperforming the S&P 500 index for years. So it’s no surprise that MSFT stock is a member of the prestigious IBD Long-Term Leaders list. Stocks on this list stabilize your portfolio but quietly deliver stellar long-term gains. To qualify as a Long-Term Leader, a stock has to have stable earnings, stable price outperformance and high-quality institutional sponsorship. These stocks can be bought on pullbacks or on breakouts.

Microsoft earnings growth has been strong, fueled by cloud computing and other cloud-based services that are in high demand during work-at-home coronavirus shutdowns. On April 29, the Microsoft earnings report for fiscal Q3 showed a 23% EPS gain while revenue rose 15%, the best top-line growth in six quarters.

Microsoft’s Commercial Cloud business saw revenue jump 30% year over year to $13.3 billion in its fiscal third quarter. Its Azure cloud-computing services surged 62%. The Microsoft Teams video calling, chat and collaboration suite keeps workers connected.

Analysts see Microsoft earnings rising 20% in fiscal 2020 and 9% in 2021.

Microsoft stock is one of only a handful of U.S.-listed companies with trillion-dollar market caps. Indeed, Microsoft stock is once again worth more than Apple, for now. In this case big is beautiful as Microsoft stock has a perfect IBD Composite Rating of 99.

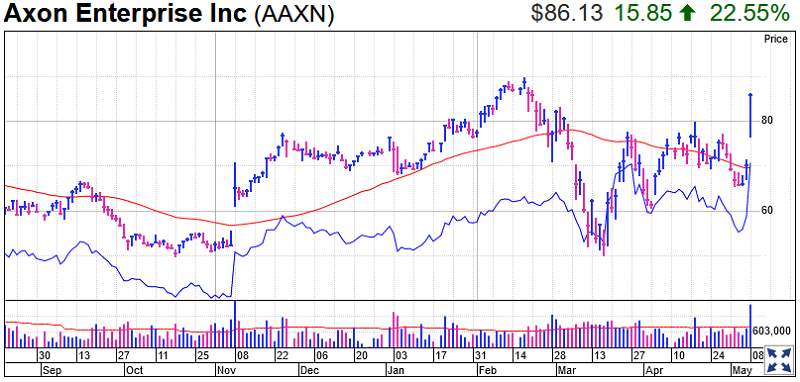

Axon Enterprise Stock

Axon stock bolted above an 80.26 buy point after the Taser maker posted stunning results late Thursday. MarketSmith analysis shows AAXN stock broke out of a cup-with-handle base and is now slightly extended from the 5% chase zone.

There were some technical hints that the recent IBD Stock Of The Day was getting set to make a big move. Axon stock reclaimed its 50-day and 200-day lines on Thursday, and closed above both key technical benchmarks.

Axon Enterprise stock has a stellar Composite Rating of 95. The IBD Stock Checkup tool shows that it boasts extremely strong stock market performance.

But even this is outstripped by Axon’s earnings excellence, which has netted the stock an EPS Rating of 98. Over the past three quarters, the stun gun maker’s earnings growth has been electric, swelling by an average of 176% over the past three quarters.

Axon earnings per share grew 90% to 40 cents, which was more than 100% above Wall Street estimates for 18 cents. Revenue rose 27% to $147.2 million.

Revenue from sales of law-enforcement cameras and cloud-based software licenses grew more than 40%. Taser revenue, which now accounts for about half of total revenue, grew 16%. Axon withdrew its guidance of $100 million to $105 million in adjusted EBITDA on revenue of $615 million to $625 million, though not because of current trends.

The hit to municipal budgets and their impact on procurement by law-enforcement agencies “could materially alter our pipeline,” Axon said.

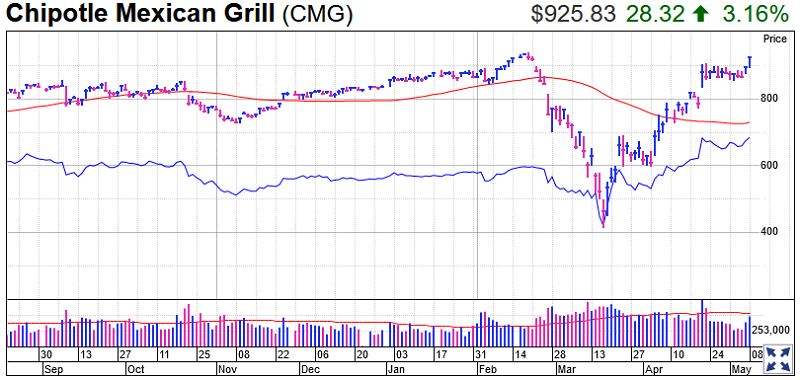

Chipotle Stock

Chipotle stock has swept into the buy zone after breaking out of a first-stage cup with handle on May 8. The ideal entry point is 909.98, but it is still actionable. Its strong recent performance has seen it take a place on the IBD Leaderboard.

Shares of Domino’s Pizza (DPZ) and Wingstop (WING), have been faring well. But those two chains were primarily delivery or takeout operations before the coronavirus bans, while Chipotle had relied heavily on dine-in customers.

Chipotle stock is currently flying high above both its 50 and 200-day lines. The reason it is so high above both key technical benchmarks is the stock has managed to increase in value by almost 11% so far this year.

Its outperformance is further reflected in its relative strength line. While it dipped slightly amid the coronavirus crash, it has roared back strongly and is now at highs last seen in 2015. This was before a string of food-safety incidents badly damaged the stock.

But there is still room for yet more improvement, as the stock’s Composite Rating is sitting at a strong but not ideal 93. The Stock Checkup tool shows earnings have grown by an average of 50% over the past three years. This is double the level sought by the CAN SLIM cognoscenti.

Chipotle stock gapped up in massive volume while still within its deep base after the chain reported upbeat earnings on April 22.

Chipotle earnings per share fell 9%, even as sales grew 7.8%, to $1.4 billion. But the key point for investors was the fact that the fresh Mexican food chain’s digital sales soared 81% and accounted for more than 26% of its business as the company has emphasized home delivery and pickup amid the coronavirus pandemic.

“Investing in digital over the last several years has allowed us to quickly pivot our business with Q1 digital sales reaching our highest ever quarterly level of $372 million,” CEO Brian Niccol said in a pres release.

“Our strong brand, business model and balance sheet give us the confidence to not only weather this downturn but continue to judiciously invest in key areas so that when we come out the other side, we will emerge even stronger.”

Niccol also cited “cooking fatigue” as people get tired of cooking at home all the time during coronavirus shutdowns.

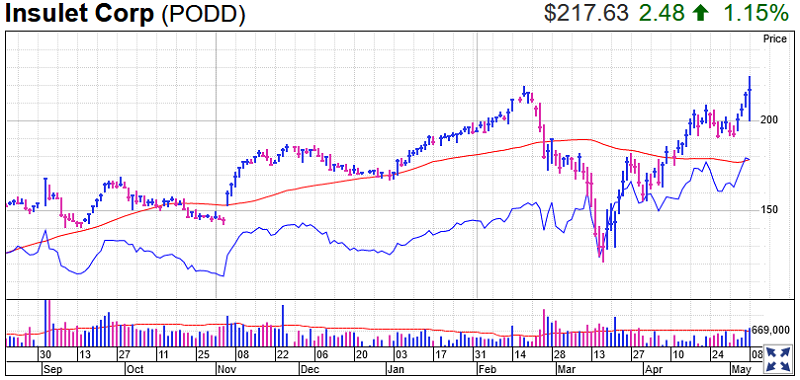

Insulet Stock

The diabetes treatment firm staged a bullish upside reversal on May 8 after reporting a wider-than-expected loss but giving decent guidance. Insulet stock closed the day at 217.63, still in range from a 209.94 cup-with-handle buy point. PODD stock had broken out a day earlier.

The relative strength line is at all-time highs, and it has generally been outperforming the S&P 500 over the past 13 months. Insulet stock hit a low point for 2019 at 80.43 last April. Since then, shares have been steadily rising.

Insulet stock currently has a Composite Rating of 81. Stock Checkup shows earnings are its Achilles’ heel, which is reflected in its EPS Rating of just 8. Nevertheless, its stock market performance has been stellar, which is reflected in its Relative Strength Rating of 96.

Insulet recently reported a net loss of 3 cents per share for Q1. That reversed from a 7-cent gain in the year-earlier period. Analysts polled by Zacks Investment Research called for a loss of 2 cents. Sales jumped 24% to $198 million, however. That easily beat forecasts for $189 million.

Insulet, which makes insulin pumps for diabetes treatment, trimmed its 2020 outlook following a mixed first quarter. It now expects 15% revenue growth in 2020, which would come out to roughly $848.7 million in full-year sales. That narrowly tops Wall Street’s estimate for $839 million in full-year revenue. Nevertheless, the fact that it is in this line of business is expected to help it weather the coronavirus recession better than most.

The viral outbreak weighs on some medical technology outlets as doctor appointments and elective procedures are delayed. But Insulet’s business benefits from recurring revenue, JPMorgan analyst Robbie Marcus said in a report to clients.

Marcus doesn’t expect Insulet to be immune from the effects of the pandemic. But he does expect the company to be better insulated than a major portion of medical technology companies.

“While Insulet will no doubt experience Covid-19 headwinds along with the rest of medtech in the coming months, the recurring revenue nature of the business and the life-or-death nature of diabetes treatment makes the company relatively well positioned over the coming months,” he said.

Insulet is in a hot group at the moment, though Dexcom (DXCM), which makes continuous glucose monitoring systems, is arguably the real leader. The latter stock is currently on Leaderboard. Tandem Diabetes (TNDM), an Insulet rival, is racing up the right side of a base, just below a buy point.

Pool Stock

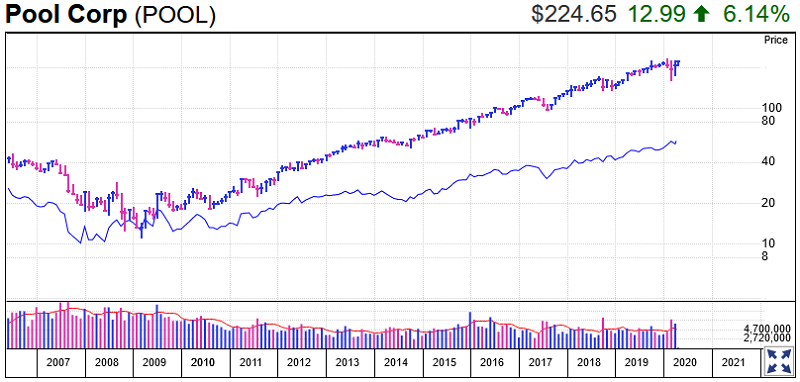

The world’s largest distributor of wholesale swimming pools is certainly making a splash. It has muscled its way on the IBD Long-Term Leaders watchlist due to its excellent performance. In addition, investor’s could soon dive into the stock, as it is closing in on a buy point.

Pool stock has formed a cup-with-handle base and is close to reaching its 229.98 buy point. It is well clear of its 50-day line.

The RS line for Pool stock is near record highs. Looking on a monthly chart, Pool stock has a long stretch of outperforming the S&P 500.

In a nutshell, an IBD Long-Term Leader is a stock with stable earnings, stable price performance, and high-quality institutional sponsorship that will outperform the market. These are stocks that you buy and, within reason, hold. All stocks that qualify also must boast quality institutional ownership. Here Pool stock scores highly, as it boasts an Accumulation/Distribution Rating of A, which reflects strong buying from institutions.

Pool stock currently holds a top-notch Composite Rating of 96. The Stock Checkup tool is also showing encouraging signs for the stock. It currently boasts average earnings growth of 22% over the past three years. While it is not quite up to CAN SLIM requirements, it is good for a Long-Term Leader stock.

Pool is showing leadership, and currently sits atop the Retail-Leisure Products industry group. Winmark (WINA) and MarineMax (HZO) are also among the group’s highest-rated stocks.

Too much volatility can be bad for your stomach, and even worse for your pocketbook during inevitable shakeouts. This is why Long-Term Leaders are important — they stabilize your portfolio but quietly deliver stellar long-term gains.

Trading Education Online Courses

TracknTrade Trading Software Free Trial