Bill Gates’ Coronavirus Manifesto Reveals 5 Forecasts For Investors By Investors Business Daily

Bill Gates’ nearly 6,500-word manifesto published Thursday paints a sobering but realistic future following the coronavirus pandemic. And investors who read closely can glean the technology maven’s outlook for key sectors and even companies.

Gates’ forecast for this epidemic, which he calls Pandemic I, isn’t pretty. “No one who lives through Pandemic I will ever forget it. And it is impossible to overstate the pain that people are feeling now and will continue to feel for years to come,” Gates said.

Gates didn’t address investors or markets directly. But he has arguably more experience eradicating infectious diseases than most through his work with the Gates Foundation. That’s on top of founding the U.S.’ most valuable company — and the only S&P 500 to not lose its $1 trillion valuation amid the coronavirus stock market crash.

Bill Gates Coronavirus Takeaway #1: This Is Far From Over

A powerful rally in recent weeks may lead investors to think a resolution is near. Gates disagrees, saying we’re just in the early part of this pandemic. He also sees coronavirus altering the course of history, much like the last world war.

“During World War II, an amazing amount of innovation, including radar, reliable torpedoes, and code-breaking, helped end the war faster. This will be the same with the pandemic,” he said. “I break the innovation into five categories: treatments, vaccines, testing, contact tracing, and policies for opening up. Without some advances in each of these areas, we cannot return to the business as usual or stop the virus.”

Bill Gates Coronavirus Takeaway #2: Sectors Would Have Suffered Even Without A Shutdown

It’s tempting to blame government shutdowns for the unprecedented spike in unemployment and stock market crash hurting key sectors. But people would have shut themselves in anyway, Gates says.

“Entire sectors of the economy are shut down. It is important to realize that this is not just the result of government policies restricting activities,” Gates said. “When people hear that an infectious disease is spreading widely, they change their behavior. There was never a choice to have the strong economy of 2019 in 2020.”

Bill Gates Coronavirus Takeaway #3: Expect Biotech Disappointments

Biotech and pharmaceutical investors should expect many disappointments and failures on the way to both treatments and a possible vaccine.

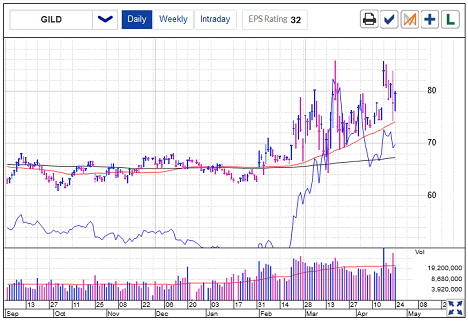

“Every week, you will be reading about new treatment ideas that are being tried out, but most of them will fail,” he said. Investors got a reminder of this when shares of Gilead Sciences (GILD) rallied and then fell on news of a possible treatment.

Gilead is one of the few public biotech companies Gates mentions by name. “For the novel coronavirus, the leading drug candidate in this category is Remdesivir from Gilead, which is in trials now. It was created for Ebola. If it proves to have benefits, then the manufacturing will have to be scaled up dramatically,” he said.

Other treatments aren’t silver bullets, either. “Hydroxychloroquine is in this group. The foundation is funding a trial that will give an indication of whether it works on Covid-19 by the end of May. It appears the benefits will be modest at best,” he said.

Bill Gates Coronavirus Takeaway #4: A Vaccine Could Be 18 Months Away

A vaccine is what investors, and the population, really want. Gates named Moderna (MRNA) as a top leader. “The first vaccine to start human trials is an RNA vaccine from Moderna, which started a phase 1 clinical safety evaluation in March,” he said.

But realistically, vaccines historically take more than five years to develop for new diseases, he says. “Short of a miracle treatment, which we can’t count on, the only way to return the world to where it was before Covid-19 showed up is a highly effective vaccine that prevents the disease,” he said. “Unfortunately, the typical development time for a vaccine against a new disease is over five years.”

Gates sees a faster turnaround this time given the level of global coordination. “Like America’s top public health officials, I say that it is likely to be 18 months, even though it could be as short as nine months or closer to two years,” he said.

Bill Gates Coronavirus Takeaway #5: A New ‘Semi-Normal’ For Sectors Looms

Sectors of the economy will face a second phase in the epidemic in two months, Gates says. It will be “semi-normal,” Gates says.

Restaurants and airlines will slowly regain business in a highly restricted manner. “People can go out, but not as often, and not to crowded places. Picture restaurants that only seat people at every other table, and airplanes where every middle seat is empty,” he said.

He points out questions restaurants will address, “For example, restaurants can keep diners six feet apart, but will they have a working supply chain for their ingredients? Will they be profitable with this reduced capacity?”

Some restaurants, like Seattle-based MOD Pizza, are already using innovation to open gradually, according to an Investor’s Business Daily report.

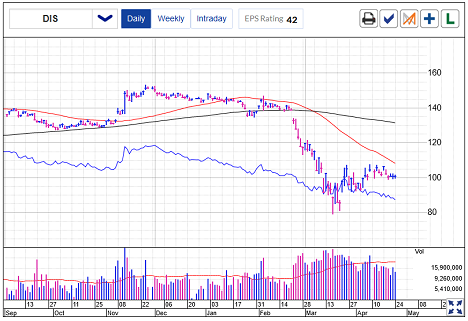

But it’s going to be a longer wait for sectors that rely on gathering large groups of people. Think theme parks, cruise ships, sporting events and concerts. These sectors could still be shut down into the spring of 2021.

“If in the spring of 2021 people are going to big public events — like a game or concert in a stadium — it will be because we have a miraculous treatment that made people feel confident about going out again,” Gates said.

“We need a treatment that is 95% effective in order for people to feel safe in big public gatherings. Although it is possible that a combination of treatments will have over 95% effectiveness, it’s not likely, so we can’t count on it.”