Technology isn’t the only sector to rise from the coronavirus stock market crash. Health care stocks’ stature is rising fast, too, giving ETF investors an opportunity to gain.

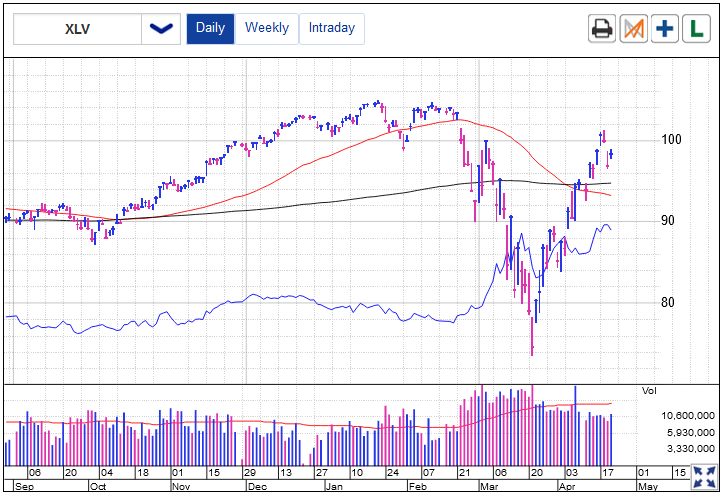

The Health Care Select Sector SPDR ETF (XLV) is only down 4.5% this year. That blows away the S&P 500’s nearly 15% drop this year. And it even puts health care ahead of other defensive plays. The Utilities Select Sector SPDR ETF (XLU) is down nearly 12% this year.

Thanks to the health care sector’s relative power, it now accounts for nearly 16% of the S&P 500. That’s up from 14.2% at the end of the year. Health care is second behind information technology with the biggest S&P 500 weight. Technology accounts for 25.4% of the S&P 500.

And S&P 500 sector investors are noticing. Nearly half the $10 billion that flowed into sector ETFs in April so far poured into health care ETFs, says State Street.

The health care sector looks like good place to investors to be, says Todd Rosenbluth, head of ETF and mutual fund research at CFRA.

“CFRA recommends an overweighted position in health care believing demand will increase in various industries due to Covid-19,” he said. “Many large cap (health care) companies have strong fundamentals that are not fully reflected in the share prices.”

S&P 500 Fundamentals Back Up Health Care

Health care’s rise isn’t just about speculation, either. Strong earnings trends back up the companies, too.

Analysts think S&P 500 health care companies will post 2.2% higher profit in first-quarter, being reported in the next few weeks, says John Butters, earnings strategist at FactSet. That growth puts the sector ahead of the expected 0.4% earnings drop in information technology. And it’s well beyond the 14.5% first-quarter profit drop expected by the S&P 500.

It gets better. S&P 500 analysts are too conservative with health care earnings. The health care companies that reported so far topped first-quarter profit forecasts by 9.4%, FactSet says. That’s a bigger upside surprise than in any sector. Health care enjoys “strong earnings sentiment in a market where earnings continue to be revised lower, for this quarter and the rest of the year,” said Matt Bartolini, Head of SPDR Americas Research at State Street Global Advisors.

And that earnings durability will be welcome if the coronavirus continues to shutter the global economy, Rosenbluth says. “During market volatility, health care as a sector holds up well due to the strong balance sheet and consistent earnings records,” he said.

S&P 500: Health Care Winners

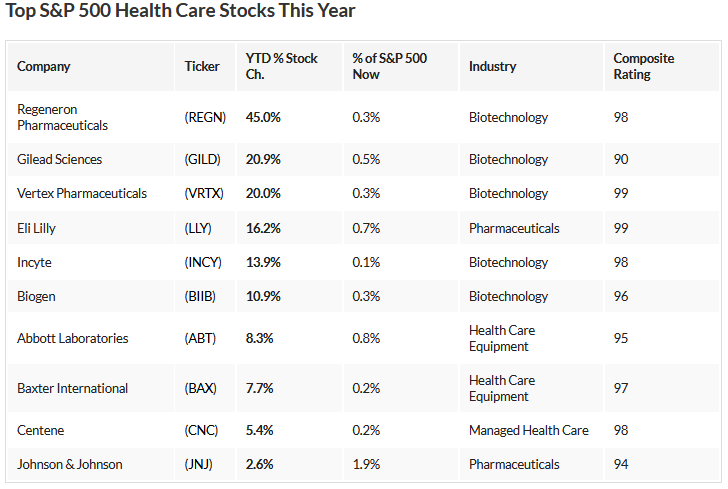

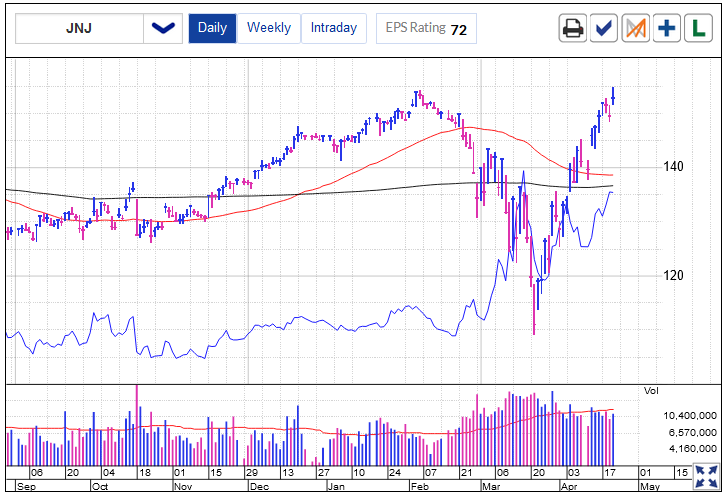

Johnson & Johnson (JNJ), in many ways, summarizes what S&P 500 investors seek: A solid company with stable growth. The drugmaker’s weight in the S&P 500 rose 0.4 percentage points this year. That’s more of a rise than by any health care company.

J&J commands a 94 IBD Composite Rating thanks to a 3.4% gain in the stock this year and solid fundamentals. The company’s earnings per share rose 6% in 2019. J&J is also one of the last S&P 500 companies with a perfect AAA credit rating, giving it staying power. J&J is just 1.9% of the S&P 500. But it’s nearly 11% of the Health Care Select Sector SPDR.

But the biggest percentage gainers are all in the biotech industry group of the health care sector. Regeneron Pharmaceuticals (REGN), Gilead Sciences (GILD) and Vertex Pharmaceuticals (VRTX) are this year up 45%, 21% and 20%, respectively. Each has a hand in developing coronavirus treatments.

But here’s the problem: Those three health care champs only account for 1.1% of the S&P 500, combined.

Health Care ETF Options Abound

Giving how diluted the top holdings are, the Health Care Select Sector SPDR makes sense. Regeneron, Gilead and Vertex account for nearly 6% of the Health Care Select Sector SPDR.

Rosenbluth also likes the iShares U.S. Medical Device (IHI). “It holds largest U.S. health care equipment companies … including Abbott Labs (ABT), Boston Scientific (BSX), Medtronic (MDT) and Stryker (SYK),” he said. The ETF is down 9.4% this year.

But Dave Nadig, chief investment officer of ETF Flows, isn’t sold on broad health care ETFs long term. “The impact of all this on health insurance companies and front-line providers and pharmacies remains to be seen,” he said. “There’s a definite risk of disruption or nationalization that could be problematic.”

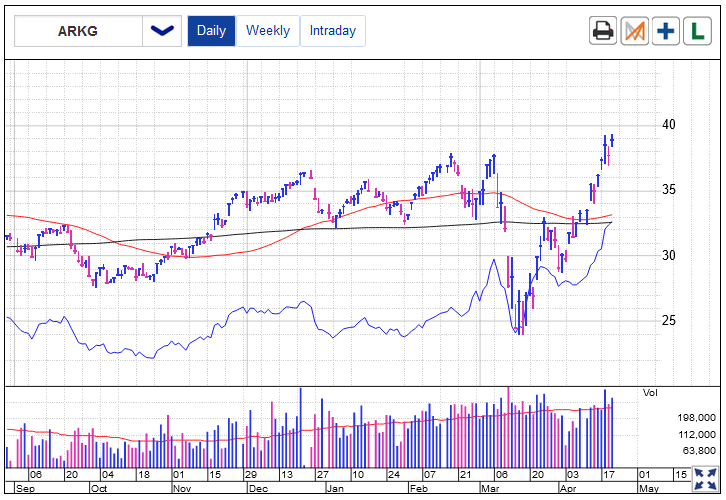

He prefers biotech focused iShares Nasdaq Biotechnology (IBB) or ARK Genomic Revolution (ARKG). IBB is up nearly 2% this year. And Ark Genomics is up 13% as it bets nearly 10% on non-S&P 500 gene analyzer Illumina (ILMN) and 9% on Cripsr Therapeutics (CRSP).

But one thing’s for sure: health care’s role in the economy is rising. Investors, above all, have a “desire to gain exposure to firms at the forefront of a health resolution through the potential development of vaccines, treatments, and testing for the Covid-19 virus,” Bartolini said.

Find Health Insurance Free Online Quotes

Nutrisystem Weight Loss and Diet Plans