First Solar Stock, Enphase Stock, Two Leaders From The No. 1 Group, Shine On Earnings By Investors Business Daily

First Solar (FSLR) and Enphase Energy (ENPH) both reported better-than-expected third-quarter earnings late Tuesday. As a result, FSLR stock and ENPH stock, two leaders in the No. 1 rated Energy-Solar group, shone brightly in overnight trading.

First Solar Earnings

First Solar earnings surged 400% to $1.45 per share, with revenue up 70% to $928 million. That blew out analyst views for First Solar earnings of 60 cents a share and sales of $707.7 million.

The solar power giant credited strength in international projects and an increase in the volume of modules sold to third parties.

“We delivered strong financial results for the third quarter,” said First Solar CEO Mark Widmar in a news release. “The dedication we continue to witness from our associates enabled us to expand module segment gross margin, close the sales of our Ishikawa, Miyagi, and Anamizu projects in Japan, and increase earnings per share quarter over quarter. This result reflects the strengths of our competitively advantaged CdTe modules and vertically integrated manufacturing process.”

The company, which makes and sells solar modules for residential and commercial markets in the U.S., Europe and Asia, said that Covid-19 hasn’t materially affected its financial results.

First Solar reinstated guidance, with Q4 targets generally below consensus.

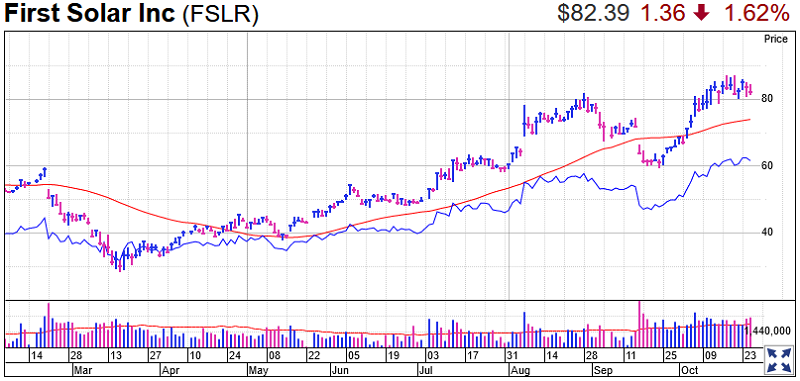

First Solar stock soared 11% to 91.33 in overnight trade. Shares fell 1.6% to 82.39 on Monday. That left FSLR stock just above an 81.97 buy point from a cup base, according to MarketSmith analysis. Investors could treat an earnings gap on Thursday as a new buying opportunity.

Enphase Earnings

Meanwhile, Enphase earnings came in flat at 30 cents a share. But analysts expected Enphase earnings to fall to 24 cents a share. Revenue fell 1% to $178.5 million vs. views for $169.79 million.

“Demand for our core microinverter products rebounded strongly in the third quarter of 2020,” the company said in a statement. “We experienced record sell-through from distribution to installers, resulting in channel inventory slightly below the low end of our typical target range. Sales to distributors improved significantly and was broad-based geographically. We were also pleased to report our first quarter of significant revenue from the sale of Encharge storage systems.”

Enphase sees Q4 revenue of $245 million to $250 million vs. views for $240.2 million.

The company designs, develops and sells home energy solutions for the solar photovoltaic industry.

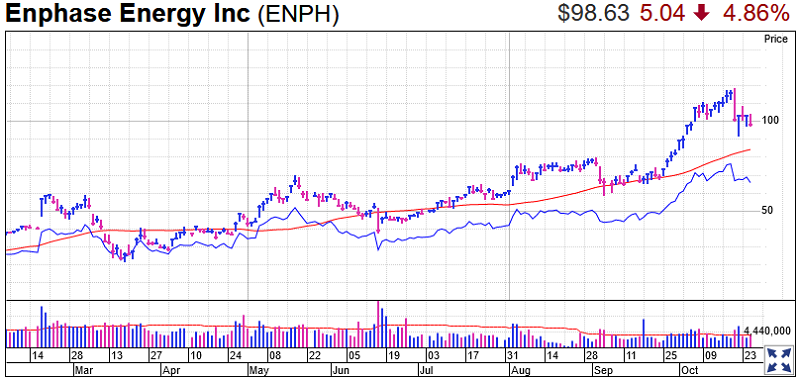

Enphase stock rose 3.5% to 102.06 overnight, off their initial after-hours highs. ENPH stock is greatly extended from a 70.46 buy point off a cup base.

Both stocks are part of IBD’s No. 1 Energy-Solar Group.

Meanwhile, SunPower (SPWR) reports earnings on Wednesday, while SolarEdge Technologies (SEDG) is due next week.

Solar Electric Inverters SMA, SolarEdge, Enphase, Outback, Xantrex, PVPowered