ServiceNow, Nvidia, Qualcomm Near Buy Points In Stock Market Rally Attempt By Investors Business Daily

ServiceNow stock, Adobe (ADBE), Nvidia (NVDA), Qualcomm (QCOM) and Veeva Systems (VEEV) are top stocks to watch this week. They have been finding support at key support levels while major indexes undercut them.

All of these top semiconductor and software stocks are near buy points. The market is in a correction, with the major indexes below their 50-day moving averages. A new stock market rally attempt is underway, but hasn’t been confirmed. So investors should be cautious about any buys.

Investors looking to buy one of these five stocks may want to tiptoe in, perhaps taking a small position near the 10-week moving average. Then wait for a new base to form and fill out the position on the breakout.

Adobe stock, Nvidia and Veeva Systems are on the IBD 50 list of top growth stocks. Additionally, ServiceNow, Adobe and Nvidia are on IBD Leaderboard. And ServiceNow and Adobe are IBD Long-Term Leaders, which highlights companies with stable earnings growth and price performance. Veeva stock is on the Long-Term Leaders watchlist.

Qualcomm stock was added to SwingTrader on Friday.

Stock Market Rally: Watch The RS Line

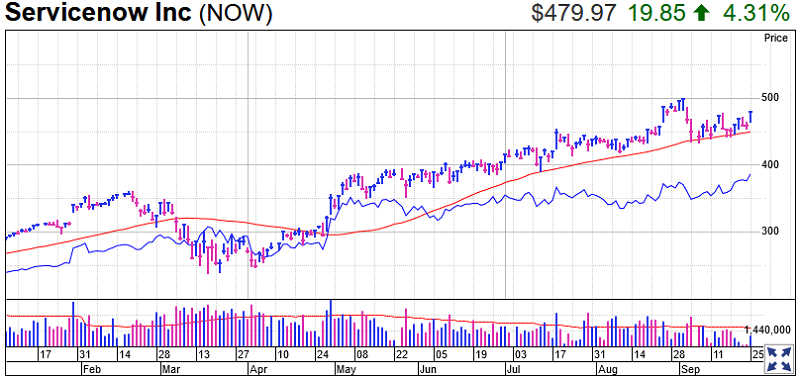

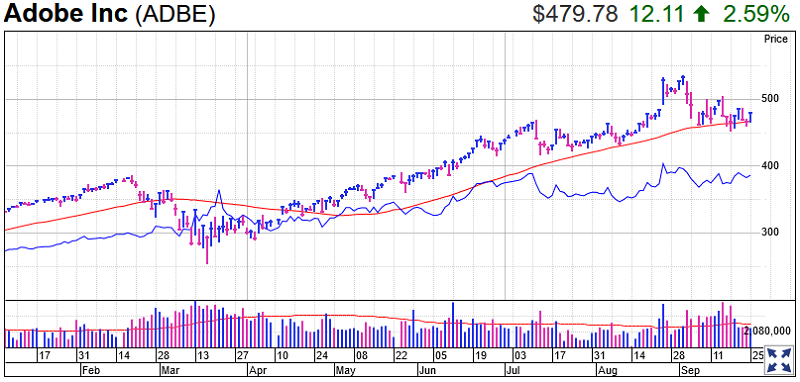

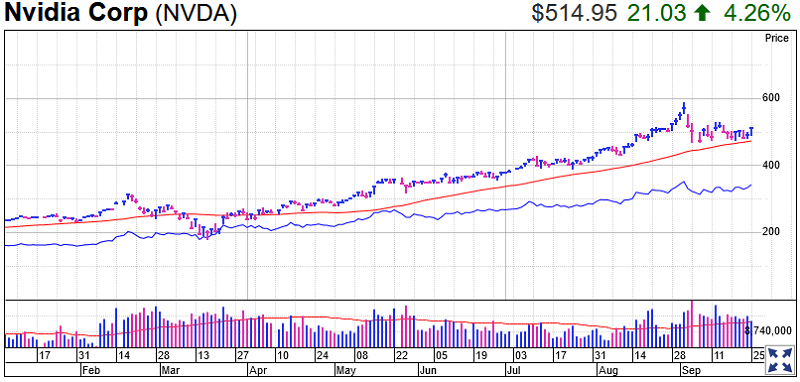

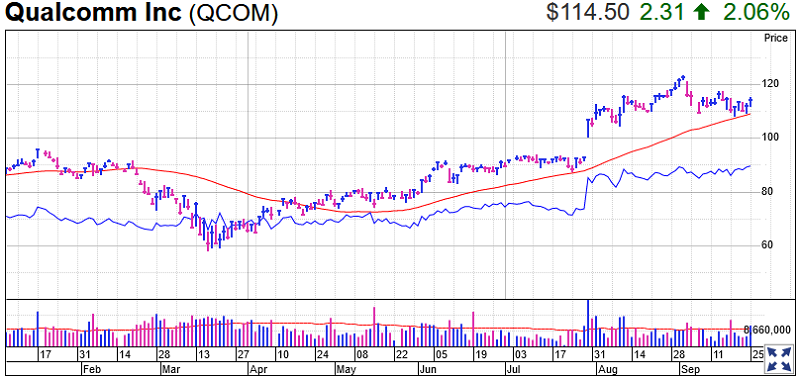

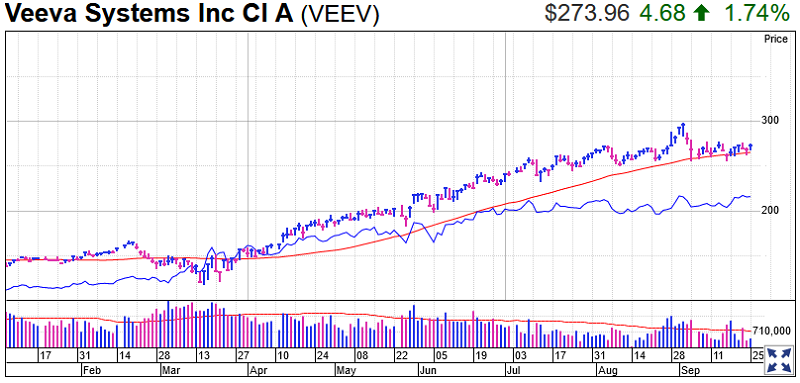

ServiceNow (NOW), Adobe stock, Nvidia, Qualcomm and Veeva are all leaders, with relative strength lines at or near highs. A rising RS line means these stocks are outperforming the S&P 500 index. It’s the blue line in the charts shown.

The RS line also is a quick way to spot winners in any market — up or down.

The Relative Strength At New High stocks list at investors.com is a great place to look for quality names with strong RS lines. IBD’s stock research platform MarketSmith has a screening tool that identifies stocks with RS lines making new highs.

In addition, the best growth stocks have an IBD Composite Rating of 90 or better. ServiceNow and Nvidia stock lead this group with a perfect Composite Rating of 99 each, followed by Veeva with a 98, Adobe with a 97 and Qualcomm with a 94. The Composite Rating combines five separate proprietary IBD ratings, based on key fundamental and technical criteria, into one easy-to-use score.

ServiceNow Stock

Shares of the enterprise software maker rose 4.3% Friday and 5.9% for the week to 479.97, bouncing from the 50-day and 10-week lines. The S&P 500 lost 0.6% for the week, falling further below the 50-day line.

ServiceNow stock is nearly 7% above its 10-week line. That’s still buyable, though investors might want to downsize their position to reflect that distance from that key support level.

The RS line for ServiceNow stock is at a record high, a sign of resilience and leadership in a challenging market.

ServiceNow stock has an an EPS Rating of 99, the highest possible. It also has an RS or Relative Price Strength Rating of 92 out of 99, and Accumulation/Distribution Rating of C. The A/C rating, on a scale of A (best) to E (worst), gauges funds and other large institutions buys and sells of a stock. Think of C as a neutral rating.

ServiceNow earnings swelled 59% annually over the past three years and sales 28%, the IBD Stock Checkup tool shows. That’s above the 25% or better a growth stock investor would want to see on both the top and bottom lines.

The latest ServiceNow earnings were a blowout, but subscription billings guidance fell short. In the past three quarters, ServiceNow averaged 51% EPS growth, which is slightly below the three-year average but still a strong number.

The company has been adding contracts despite the coronavirus hit to businesses.

Adobe Stock

The publishing and marketing software maker gained 2.6% to 479.78, back in buy range from a 470.11 flat-base buy point. Adobe stock also found support at the 50-day line. The RS line is just below recent highs.

Adobe has an EPS Rating of 99, RS Rating of 89 and A/D Rating of D.

Adobe earnings rose 32% annually over the past three years and sales 22%.

Over the past three quarters, Adobe earnings per share growth averaged 30% but slowed to 25% in the latest quarter.

Adobe’s Digital Media unit, which includes the Creative Cloud suite of subscription software, drove growth in the latest Adobe earnings report. The successful pivot to subscription software has fueled Adobe stock.

Nvidia Stock

Shares of Nvidia leapt 5.6% to 514.95 this past week, rebounding from just above its 10-week line. Its RS line is at its highest level in a year.

Nvidia stock is 8% above its 10-week line, still buyable, but at higher risk.

The chip giant has an EPS Rating of 99, RS Rating of 96, and A/D Rating of B+.

Nvidia earnings climbed 12% annually over the past three years and sales 9%. It’s returned to bullish growth as the chip sector recovers, with EPS growth averaging 105% over the past three quarters.

But EPS growth slowed to 76% in the latest Nvidia earnings report, though that’s still a very strong number amid the coronavirus crisis. Chips for games and data centers, along with M&A hopes, have pushed Nvidia stock higher.

Qualcomm Stock

Qualcomm gained 3.4% to 114.50 for the week, rebounding from the 10-week line and reclaiming the 21-day moving average. It’s offering a buy point around 110. Its RS line has also risen to new highs.

The wireless-chip maker has an EPS Rating of 75, RS Rating of 90 and A/D Rating of B.

Qualcomm earnings have fallen in the past three years while sales grew 1% annually over the period.

But business has rebounded, with Qualcomm earnings per share averaging 27% over the past three quarters. Qualcomm earnings growth slowed to 8% in the latest quarter but it’s bullish on the 5G smartphone opportunity.

The chipmaker has also overcome key legal overhangs, stoking Qualcomm stock higher this year. The FTC on Friday did file a motion to appeal an antitrust case it lost to Qualcomm. QCOM stock pared Friday’s intraday gains, but not by much.

Veeva Stock

Shares of Veeva Systems advanced 3% to 273.96. Support at the 10-week line provides an entry around 263, with shares in buy range. Its RS line is at a record high.

The software maker for biotech companies earns an EPS Rating of 99, RS Rating of 94 and A/D Rating of C+.

Veeva grew earnings 46% annually over the past three years and sales 27%.

Over the past three quarters, Veeva earnings per share growth has averaged 27%. The latest Veeva earnings report highlighted its strong outlook for the year, as companies race to make a coronavirus vaccine.

Trading Education Online Courses

TracknTrade Trading Software Free Trial