Microsoft Among Five Long-Term Leaders In Buy Zones Now By Investors Business Daily

Your stocks to watch for the week ahead include several Long-Term Leaders hovering in buy zones. They include Microsoft stock, Adobe (ADBE) and ServiceNow (NOW). UnitedHealth (UNH) and Dollar General (DG) also represent potential buys.

Investors can hold Long-Term Leaders such as Microsoft stock for an extended period of time, barring a massive breakdown. But the best time to buy those stocks, IBD research suggests, is after they rebound from their 10-week line, a key support level at which strong stocks often take a breather.

Investors can buy stocks off their rebound from the 10-week line as long as that rebound doesn’t stretch past 9% above that line. However, investors should size their positions accordingly.

Microsoft Stock, Other Long-Term Leaders

Investors also can buy Long-Term Leaders as position trades. Adobe stock, Microsoft stock and ServiceNow are all on IBD Leaderboard. Microsoft, Adobe and ServiceNow stock are also on the IBD 50.

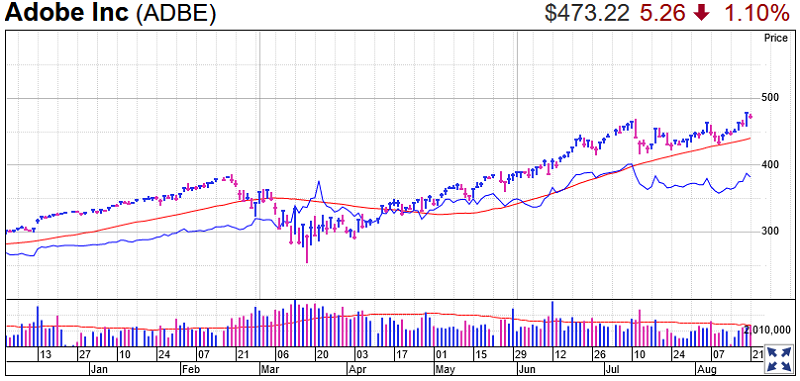

Adobe Stock

Adobe stock on Thursday cleared a flat base with a buy point of 470.71, according to MarketSmith, hitting a record high. Shares of the digital design company in Friday’s stock market trading eased 1.1% to 473.22. The stock got a bounce off its 10-week line earlier this month. Shares were nearly 7% above the 10-week line.

Adobe’s Composite Rating and EPS Rating both stand at 99, the best possible. Its relative strength line has been choppy in recent weeks. Adobe stock has risen 43.5% this year.

Adobe is known for programs like Photoshop and Acrobat, along with marketing software and analytics tools. Adobe, along with other big tech stocks, transitioned to a cloud-based software subscription model. Also, the company in June reported fiscal second-quarter earnings that beat estimates. However, sales missed.

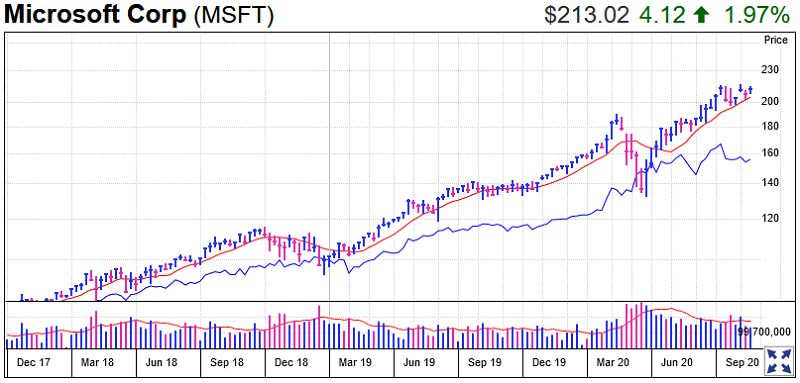

Microsoft Stock

Microsoft (MSFT) stock is about 4% above its 10-week line. Investors could also pick up the stock once it clears 271.74, which is 10 cents above the high its shares reached on Aug. 3. Shares rose 2% last week to 213.02.

Microsoft stock has a 96 Composite Rating and a 95 EPS Rating. The stock’s relative strength line is off highs reached last month.

Similar to the other tech stocks mentioned here, Microsoft stock has benefited from rising demand for cloud services, as more people work from home in an effort to reduce coronavirus infections.

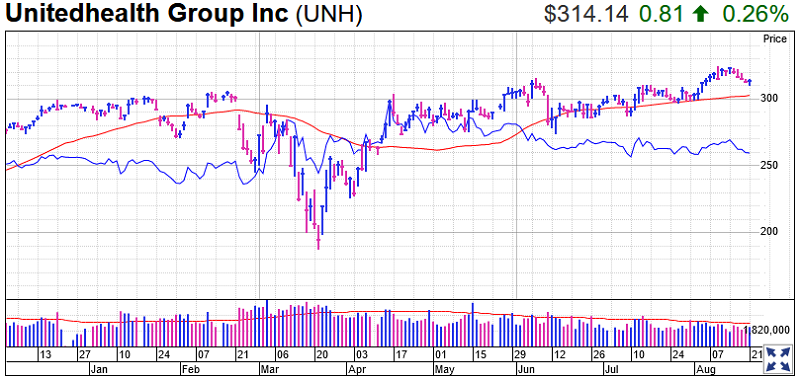

UnitedHealth Stock

UnitedHealth stock is still above a 311.07 buy point of a cup-with-handle base but has pulled back toward that entry in recent days. Shares ticked up to 314.14 on Friday. The nation’s biggest managed-care company is 3.6% above the 10-week line.

UnitedHealth stock has an 89 Composite Rating. Its EPS Rating is 96. The stock’s relative strength line has trended lower since May.

The company has managed to maintain a strong earnings growth rate over the years. However, earning gains during the pandemic have come as Americans stayed home and consumed fewer health care services. But as doctor and hospital visits rebound, UnitedHealth’s expenses will too.

Like Microsoft, UnitedHealth is a Dow Jones stock.

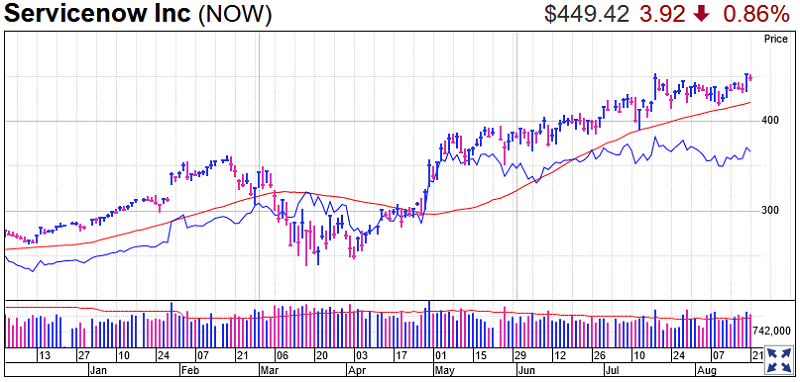

ServiceNow Stock

ServiceNow has cleared a short consolidation with an early entry of 445.25. Investors could also move in when when the stock tops 454.79. ServiceNow fell 0.9% to 449.42 on Friday, but climbed 3.1% for the week.

The stock is 6% above the 10-week line, still buyable by that measure.

ServiceNow’s cloud-based platform attempts to automate and consolidate the ways workplaces handle different procedures, from hiring to customer service. The company’s second-quarter earnings and revenue beat expectations last month. But its subscription billings forecast was below estimates.

Dollar General Stock

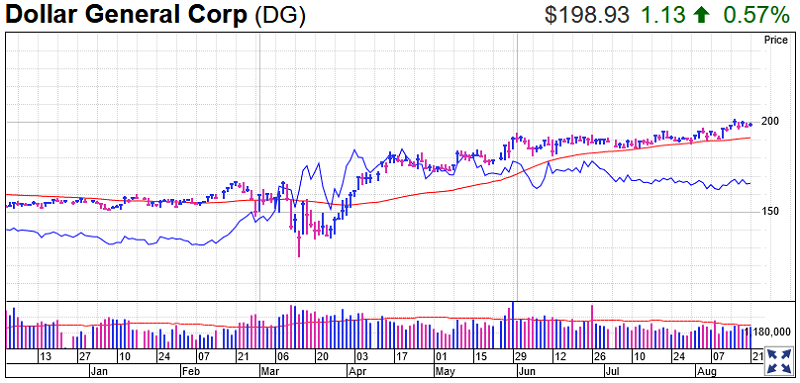

Shares of the discount retail chain are holding above a 194.94 buy point from a flat base, just edging higher for the week to 198.93. The stock also is 3.6% above its 10-week line.

Dollar General stock has a 99 Composite Rating and an EPS Rating of 96. The dollar store operator reports second-quarter earnings on Thursday. So will peer Dollar Tree (DLTR) and close-out retailer Ollie’s Bargain Outlet (OLLI), which are hovering right around buy points.

An ailing economy tends to drive more people to dollar stores, as they seek out cheaper purchases. CFRA named Dollar General “Covid-19’s biggest winner.”

September 08 How To Develop Winning Trading Systems That Fit You Workshop

Trading Education Online Courses