Mini-Manias: Beware Short-Term Trading Frenzies Like This One By Elliottwave International

Most investors know the meaning of a “mania,” i.e., the “Tulip Mania” of the 1600s and more recently, the mania surrounding technology stocks in the late 1990s, etc.

As you might imagine, these manias usually occur during rip-roaring bull markets.

Yet, some “manias” may unfold even during bear-market rallies, and when these “mini-manias” end, they can burn investors just as much as those full blown bull market manias.

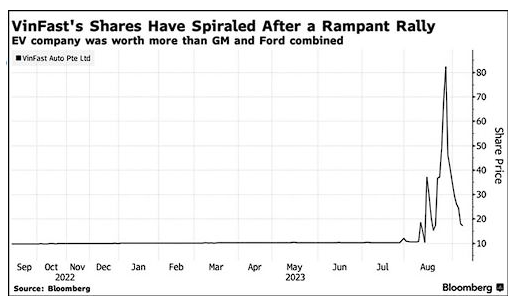

For example, consider VinFast, an electric car maker based in Vietnam. The company debuted on the NASDAQ on Aug. 15. Just a week later, we had this headline Reuters, Aug. 22:

VinFast shares more than double to highest since market debut.

The price of the shares went on to much more than “double” in a very short period of time.

Our September Elliott Wave Theorist offered this perspective:

The Elliott wave rallies peaking in 2023 have had their own mini manias…

As you can see in the chart, a money-losing electrical vehicle company operating out of Vietnam became the sudden focus of an impulsive buying spree lasting only two weeks. But what a spree it was! VinFast reached a total market value higher than that of McDonald’s and four times higher than that of GM. The stock topped on August 30.

Investors who believe in the future of electric cars went out on a limb pricing VinFast where they did. None of the bidders did any research. They just pressed buy buttons because others were doing it.

Indeed, as a Sept. 9 Bloomberg headline noted:

VinFast’s 504% Rally Burns Traders Playing Greater Fool Theory

Also, since the September Theorist published, VinFast’s share price has continued to plummet.

But what about the broader stock market?

Well, as history shows, dramatic price moves can happen with the main indexes too.

Get our latest analysis of the main U.S. stock indexes via an exciting limited-time special offer by following the link below.