Why Swing Trade?

Swing trading offers a strategic approach that focuses on capturing smaller gains from short-term trends and minimizing losses. While the gains may be relatively modest, when consistently applied over time, they can accumulate into significant annual returns. Typically, swing trading positions are held for a few days to a couple of weeks, but they can also be extended.

The Strategy of Swing Trading

Let’s begin with the fundamentals of a swing trading strategy. Instead of aiming for 20% to 25% profits on your stocks, the goal is to achieve more modest gains of around 10% or even 5% during challenging market conditions.

Although these gains may not appear as life-changing rewards commonly sought in the stock market, the key factor here is time.

Unlike traditional investing where gains develop over weeks or months, the average duration of a swing trade is shorter, typically ranging from 5 to 10 days. By consistently achieving smaller wins, you can accumulate substantial overall returns. If you are content with a 20% gain over a month or longer, gaining 5% to 10% every week or two can lead to significant profits.

Of course, losses must also be considered. Small gains can only contribute to portfolio growth if losses are kept minimal. Instead of the usual 7% to 8% stop loss, it’s advisable to cut losses at a maximum of 3% to 4%. This approach maintains a 3-to-1 profit-to-loss ratio, which is a sound rule for successful portfolio management. This aspect is crucial because a substantial loss can swiftly erase progress made with smaller gains.

Swing trading still allows for the possibility of larger gains on individual trades. A stock showing strong initial momentum can be held for a bigger gain, or partial profits can be taken while leaving the remaining position to continue its upward trajectory.

Swing Trading and Fundamental Metrics

Although the fundamental metrics are primarily designed for longer-term investments, its principles can still apply in a swing trading environment.

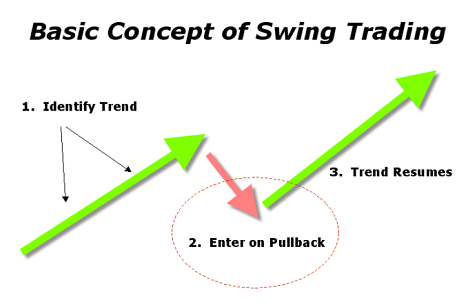

One aspect involves taking advantage of breakouts from consolidations. Prior uptrends are essential, and sideways movement that resists significant decline is preferable. High Relative Strength Ratings serve as a key indicator for narrowing down your selection to the most promising prospects. Additionally, volume provides confirmation that institutional investors are accumulating shares. The difference in swing trading lies in the time frame.

Instead of waiting for consolidations that typically last a minimum of five to seven weeks, swing traders may focus on periods half that duration or even less.

The flexibility to consider shorter time frames stems from adjusted profit goals. To achieve gains of 5% to 10%, the requirements are much lower compared to aiming for prior uptrends of 30% or more, which necessitate a more extended base structure. Likewise, the volume characteristics of a breakout can be assessed within a shorter time frame. Rather than relying on the 50-day moving average of volume as the threshold for significant turnover, look at the volume within the recent consolidation area for clues. If the breakout volume exceeds the recent activity, it can provide sufficient confirmation of strength.

Swing Trading Compared to Day Trading

Swing trading and day trading may appear similar at first glance, but they differ primarily in terms of time.

Firstly, the holding periods for trades vary. Day traders enter and exit positions within minutes or hours, while swing trading typically spans several days or weeks.

Due to the shorter time frame, day traders usually avoid holding positions overnight to mitigate the risk of significant price gaps resulting from after-hours news announcements. In contrast, swing traders must be cautious about a stock’s opening price, as it can differ significantly from the previous day’s closing price.

However, the shorter time frame in day trading carries its own risk. Wide bid-ask spreads and commissions can consume a considerable portion of profits. Swing traders may also encounter this issue, but it is more pronounced for day traders. Day traders often have the option to leverage their portfolios with more margin, offering four times the buying power instead of double. Larger leveraged positions can potentially increase percentage gains to offset costs. Nonetheless, nobody is consistently right all the time. Lack of focus, discipline, or even bad luck can result in a trade moving against a day trader in a significant way. One bad trade or a series of losses can deplete the account to such an extent that recovery becomes unlikely. While a swing trader can also experience losses or a significant loss, the lower leverage reduces the chances of a wiped-out portfolio.

This leads to another difference related to time: the time commitment. Successful day trading demands constant focus and attention on multiple positions, continually seeking new potential opportunities throughout the day to replace exited positions. Day trading is a full-time job rather than a side venture.

The additional time commitment in day trading introduces its own set of risks. Relying solely on trading for income without a steady paycheck adds stress and emotional pressure to the process. Emotions in trading often lead to poor decision-making.

In contrast, a swing trading style may involve a few transactions on some days and none on others. Positions can be periodically checked or managed through alerts triggered by critical price points, reducing the need for constant monitoring. This approach allows swing traders to diversify their investments and maintain a calm and rational mindset while investing.

To further save time, the Invest2Success Stock Advisory assists by providing daily low-risk high-reward buy-long sell-short trade plans of price entry, stop-loss, take profit price targets, streamlining the process for you.

The Invest2Success Stock Advisory is similar to a swing trading method of analyzing leading companies’ fundamental metrics first, then technical analysis to create low-risk high-reward trade plans of entry price, stop-loss, and take profit price targets.