How This Pattern from the Prior Housing Bust is Repeating By Elliottwave International

Here’s when homes will likely sell for once-in-a-lifetime bargain.

Just like the gold “in them thar hills” motivated people from all walks of life to become miners way back when, real estate booms have motivated people from far and wide to become agents.

In both cases, easy riches seemed to be there for the taking.

But easy riches can be hard to get sometimes, as this New York Times headline indicates:

As Housing Market Cools, Far Fewer Become Agents

You might think that was from the past few months. No, the date of the headline’s publication was Sept. 7, 2007.

This next one is recent — a New York Post headline from Jan. 31 of this year:

Real estate agents vanish en masse as market slows — even in once red-hot Miami

So, agents are closing shop again — just like 15 or 16 years ago — before the worst of the prior housing bust.

The question is: Will this latest weakness in the property market turn out to be as severe as the last time?

No one knows for sure, of course, but Elliott Wave International’s analysis strongly suggests that real estate agents, homeowners, would-be buyers and would-be sellers might want to prepare for a worst-case scenario.

As Robert Prechter noted in his book, Last Chance to Conquer the Crash:

At the bottom, buy the home, office building or business facility of your dreams for ten cents or less per dollar of its peak value.

Remember, financial changes can happen quickly and dramatically.

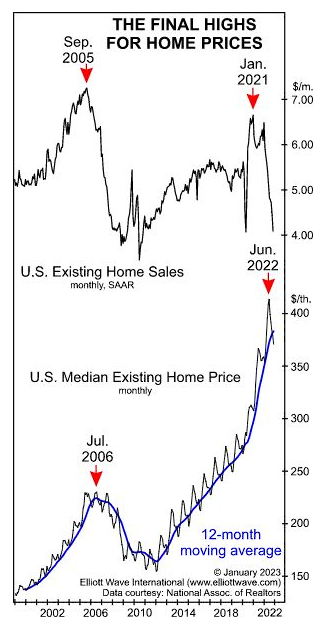

That was the case with the 2007-2009 financial crisis. And, as indicated, changes are already underway in real estate again. This chart and commentary from our February Elliott Wave Financial Forecast, a monthly publication which covers major U.S. financial markets, provide more insight:

The monthly chart of existing home prices shows that the June-to-November decline brought the first break of the 12-month moving average since the first quarter of 2020. This is not unusual; the chart shows a seasonal tendency for prices to decline in the second half of the year. What is highly unusual, however, is the seasonal decline’s refusal to break below the 12-month average in 2020 and 2021. The sharp decline in sales, the five wave rise from the 1960s in home prices and the ability for prices to stay above the 12-month average for two straight years suggest that the current move below the 12-month average is no ordinary decline.

The bottom line is that it’s best to prepare now for swift changes ahead — not only in housing, but in financial markets and the economy generally.