See the Chart for Yourself: The “Quick Shift” to “Cash is King” By Elliottwave International

Remember about two years ago when the government and mainstream media were warning us about inflation? Me neither. That’s because they didn’t.

In truth, it was barely one year ago when policymakers and the media still tried to tell us that inflation was “transitory.” We “don’t need to panic.”

They missed the inflation story. In contrast, our publications first warned subscribers of coming inflation in February 2020. More on that below.

In practical terms, inflation means that your dollars become less valuable as prices rise. The Federal Reserve’s “target” is two percent inflation a year, so we hear all the time that you can’t leave your money in cash since inflation eats away its value. Cash is trash, we’re told. You need to put your money in investments that will return more than the rate of inflation… like the stock market.

The thing is, just as government and the mainstream fail to see bubbles and crashes coming, they’re just as mistaken to claim that putting money in the stock market is the way to “beat inflation.”

The financial world is full of myths that masquerade as wisdom: Buy the dip, sell the rip. Invest for the long haul. Cash is trash.

Alas, the folks who miss every major turn in the stock market are often the same ones who repeat these sayings. They work for a while–until they don’t. And that’s when bad advice leaves you holding the bag. There’s a better way.

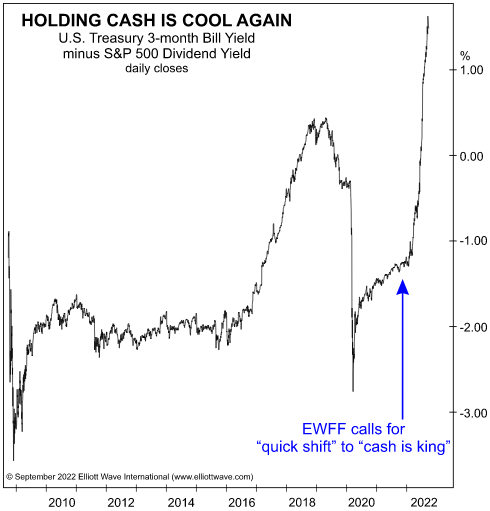

The chart above tells a simple truth: When interest rates rise and the stock market falls, cash (and cash equivalents) gain value.

Back in October 2021, we knew that the inflationary trend was unfolding and that interest rates were rising. What’s more, our long-term stock market forecast said a major peak was at hand. That’s why the October 2021 Elliott Wave Financial Forecast called for a “quick shift” to “cash is king.” What followed that forecast speaks for itself.

These Elliott wave insights allowed us to alert our subscribers to the fast-approaching risks and opportunities that come with inflation — far from being trash, cash would be king and outperform stocks. You wouldn’t have heard that analysis in many other places.

Would you like to have financial market analysts working for you in ways that put you ahead of the herd? Recent market action gives us a pretty good idea of where we’re headed. Don’t be blindsided by what’s next. Navigate the financial waters with a team you can trust. Your peace of mind is surely worth it.

Subscribe now to the Financial Forecast Service. Our Elliott wave charts, analysis and forecast can be the edge you won’t find elsewhere.